Thinking about breaking into the UK market? This is the guide for you.

The UK is the perfect starting point for North American brands looking to launch into Europe. It’s home to some of the world’s most engaged shoppers – over 67% of 35–44-year-olds have purchased something from an international brand in the last year.

However, between VAT rules, shipping options and market expectations, it can be tricky to know where to start.

From EORI and VAT numbers to warehousing and fulfillment, our guide covers some of the key things you’ll need to consider as a North American brand launching into the UK.

Jump to:

- Why the UK?

- What are UK Consumers Like?

- Logistics

- Value Added Tax (VAT)

- The UK Market Entry VAT, Compliance and Logistics Checklist

Why the UK?

The UK is a great place for North American brands looking to break into new markets, especially as a first step into Europe. Here’s why:

A Shared Language

Localization for US and Canadian brands will be smooth sailing with our shared language. You’ll have little to no translation costs, making customer service and marketing easier.

A Shared Tax System

If you operate in or out of Mexico, you’ll already be familiar with VAT, the UK’s equivalent to Sales Tax.

Similar Payment Cultures

Credit and debit cards, PayPal, Klarna and other payment infrastructure familiar to North American brands are in regular use in the UK.

Preferential Trade Deals

The UK has long established trade deals with all North America that include preferential tariff rates on goods with Mexican, Canadian and US origin.

Launchpad into the EU Market

The UK may no longer be a member of the European Union but its relationship with the EU single market remains strong. UK logistics, tax and compliance partners can easily help you expand into the EU when you’re ready.

What are UK Consumers Like?

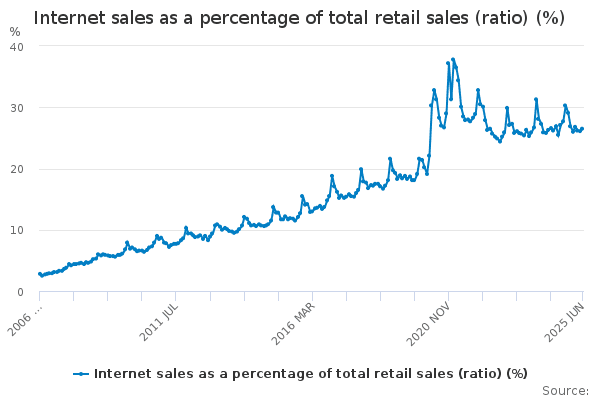

The UK has a large, digitally-savvy consumer base, with one of the highest e-commerce penetration rates in Europe. According to Statista, 84.7% of people will be shopping online in the UK in 2025 – that’s 58.9 million people. A quarter of all retail purchases made in the UK are made online.

Source: Office of National Statistics

The Sustainability Trend

Sustainability is important to UK consumers – 27% have abandoned a cart due to environmental concerns. They’re looking for brands that demonstrate social responsibility, whether that’s eco-friendly product lines, greener packaging commitments or ethical sourcing practices.

Value-driven story telling is a powerful tool to attract UK consumers, who are more likely to buy from businesses that share their values.

Social Shopping

In 2023, 69% of people in the UK used their phone to buy something online and 73% of under-45s made a purchase on a social platform. If social media isn’t already one of your sales channels, you should consider it as part of your strategy for the UK. Either way, optimizing for mobile is a must.

International Demand

Every year UK consumers are more likely to purchase from international brands – particularly younger consumers. Data from 2024 shows that…

- 67.5% of 35 to 44-year-olds

- 64% of 25 to 34-year-olds

- 61.4% of 16 to 24-year-olds

…bought something from an overseas retailer in the past 12 months.

If you’re in the fashion and accessories category, you’ll find even more demand. When UK consumers buy from international sellers, they’re most often buying fashion. 70.2% of overseas purchases fall into that . Overall, fashion made up half of all online purchases in the UK in 2024.

Logistics

Launching a North American brand in the UK starts with getting your products there and partnering an in-market 3PL to save time, hassle and cost. This section covers what you’ll need to know about import processes, warehousing, shipping and returns.

Importing into the UK

To sell in the UK, you’ll need to move your goods across borders and through customs. That means knowing your responsibilities as the Importer of Record (IOR), the party legally responsible for ensuring goods are compliant and duties/VAT are paid.

You’ll also want to understand Incoterms – especially DAP (Delivered at Place) and DDP (Delivered Duty Paid). With DAP, the customer pays duties and taxes, which can lead to surprise fees and slower delivery. DDP means you handle all import costs up front, resulting in a smoother experience for your UK customers.

Find out more about DAP and DDP shipping >

EORI Numbers

An Economic Operator Registration and Identification (EORI) number, is an identifying number that allows you to import into Britain and reclaim import VAT. You must have one before you import anything into Britain. It’s separate from your VAT number but tied to it.

Both Britain and the EU use EORI numbers but they’re not interchangeable. You can’t use a GB EORI number in the EU.

Find out when you need an EORI number and how to get one >

Fulfillment & Warehousing

Whilst shipping UK orders from North America can work, holding stock with a UK-based 3PL means you can reach UK customers faster, at lower cost and with less hassle due to complex customs processes.

With the UK consumer expecting fast and efficient delivery, problem-free returns and choice of where to buy, having an in-market fulfillment partner helps you to meet these expectations more easily.

Whether you are launching into retail first or testing the waters with e-commerce, it’s important to choose a 3PL with omnichannel fulfillment expertise so your brand is more accessible and open to more retail opportunities.

Find out more about ILG’s Omnichannel Fulfillment services >

Delivery & Shipping

In the UK, 47% of consumers abandon purchases due to high delivery costs or limited options, rising to 65% of Gen Z customers. This emphasizes not only the importance of speed but also choice when it comes to delivery.

Some popular UK carriers include:

- Royal Mail

- DPD

- Evri

And when it comes to choice, ILG partners with specialist carriers like Fin and InPost for consumers looking for more sustainable or convenient choices – important for the UK consumer.

Returns

Returns are an inevitable part of e-commerce in the UK and consumers expect simple, efficient and low-cost options.

Partnering with a UK-based 3PL means your customers have a local returns address and can receive faster refunds, exchanges or replacements.

With ILG’s global returns service, you get a clear view of all your returns data and your customers enjoy more choice, adding up to easier processing and faster return to stock for resale.

Customs

Every shipment into the UK needs the correct customs documentation, including:

- Commercial invoice

- HS codes (Harmonized System codes for your products)

- Country of origin

Read our complete guide covering everything you need to know about shipping from the US to the UK, or if you’re based in Canada, read our guide to UK Market entry.

Value Added Tax (VAT)

Most goods and services sold to UK consumers are subject to Value Added Tax (VAT).

How Does VAT Work?

VAT is an indirect consumption tax paid by the buyer to the seller. VAT is added at every stage of a product’s production and distribution. It is a percentage added to the net value of the product.

Sellers are responsible for charging their customers VAT, then reporting and paying that amount to the tax authority – which in the UK is His Majesty’s Revenue and Customs (HMRC). Before you can do this however, you need to register for VAT.

The UK has three VAT rates:

- Standard 20%

- Reduced (5%)

- Zero (0%)

The rate you apply depends on the category of product you’re selling. For example, children’s car seats are reduced-rated, while children’s clothes are zero-rated. Some goods and services are exempt, which means no VAT is charged. Exemption is different from zero-rated. Whilst you don’t have to collect any money on sales of zero-rated goods, you must still report those sales on a VAT return. If you only sell exempt goods, you cannot register for VAT.

One big difference between VAT and sales tax is that VAT is always included in the display price, unless otherwise noted. For example, if your business is based in the US and you sell cosmetics with a net value of £200 to a customer based in the UK, you would collect 20% (£40) of the gross sale price in VAT from the customer at the point of sale (they will pay you a gross of £240) and pass it to HMRC.

Since the UK left the European Union, some VAT rules in the UK differ when it comes to Northern Ireland. Sales to and stock stored in Great Britain (England, Scotland and Wales) follow UK VAT rules. Northern Ireland is still in the EU Customs Union for goods, so some EU VAT rules apply.

Do You Need to Register for VAT?

Whether you need to register depends on:

- Where your goods are at the point of sale

- Where you’re selling your goods (your own website or an online marketplace)

| Sold on your own website | Sold on an online marketplace | ||

| Goods in UK at point of sale | You’ll need to register | The marketplace collects and pays the VAT to HMRC, but you’ll need to register because you own goods held in Britain. You are making a zero-rated supply of goods to the marketplace, and that transaction needs to be reported via a VAT return | |

| Goods outside GB | <£135 | You’ll need to be registered from your first sale | You don’t need to register. The marketplace will collect and pay the VAT on your behalf |

| Goods outside GB | >£135 | You decide who will be the Importer of Record: you or your customer. If you are, you must register, collect and pay VAT | You decide who will be the Importer of Record: you or your customer. If you are, you must register, collect and pay VAT |

The UK has a £135 import rule that acts a little like the USA’s de minimis rule. Goods imported into the UK in shipments with an intrinsic value of less than £135 don’t have customs duty or import VAT applied at the border. You have to be registered for VAT to use this rule and the goods must be:

- Sold on your website, not a marketplace

- Sold to a consumer, not another business

- Outside the UK at the point of sale

If you’re importing goods into Northern Ireland from outside the UK and EU, you’ll need to register for Import One Stop Shop (IOSS) to use the £135 rule. Importing goods into Northern Ireland from an EU country requires a One Stop Shop (OSS) registration. The One Stop Shop schemes are EU VAT schemes. Once you’re registered for them, you can use them across the EU – not just Northern Ireland.

Even if you don’t qualify for the £135 rule, being registered for VAT has its benefits:

VAT Refunds

When you’re VAT registered you can claim back input VAT on your VAT return. Input VAT is the amount you have paid, both on import and on goods and services your business purchases in the UK.

Cashflow Management

Being registered for VAT in the UK means you can use Duty Deferment and Postponed VAT Accounting. These schemes let you pay any duties or VAT due on your imports all at once at the end of the month rather than every time goods cross the border.

A Better Customer Experience

Shipping your orders DAP saves you from having to pay anything at the border, but the trade-off is in your customer’s experience. Delivery delays and surprise costs put off customers from ordering and prevent them from becoming repeat customers.

How to Register for VAT

On average, it takes 10-14 weeks for HMRC to process a VAT registration. Once you’re registered, you’ll be given a GB VAT number (or XI if you’re registering for Northern Ireland). You don’t need to form a company in the UK to register for VAT, but you might need a customs representative to import your goods if your business isn’t based there.

HMRC requires several pieces of evidence that you will be ready to trade within 30 days of receiving your registration. This could be details showing you are preparing to trade, or documents that evidence your business is already doing so.

Evidence of preparing to trade:

- Documents showing you’re preparing to use an online marketplace, like emails showing your account registration

- Invoices for goods you’ve brought for re-sale

- Contracts between you and importers

Evidence of current trade:

- Your Seller IDs

- Details of your website

- Sales Records

- Import Records

Any contracts you have between your business and fulfillment houses or importers carry the most weight, and without them it is hard to get your registration approved.

VAT Returns

A VAT return is a report that you must file once you’re registered. It tells HMRC:

- How much VAT you charged on your sales (output VAT)

- How much VAT your business has paid (input VAT)

- The difference between the two

The difference between your input and output VAT determines whether you owe VAT or are due a refund. Even if you don’t make any sales in a reporting period, you still have to file a return, so HMRC knows that you have nothing to pay.

In the UK, VAT returns are filed once every three months. The deadline for filing is one month and 7 days after the reporting period. So, if your reporting period is January – March, you have until the 7th of May to file your return. The filing dates specific to your registration can be found on your VAT certificate.

The UK Market Entry VAT, Compliance and Logistics Checklist

Everything you need to do to get started in one easy list.

VAT & Compliance

- Check whether you need to get registered for VAT

- Get registered for VAT

- Get a GB or XI EORI number

- Learn how returns and refunds work under VAT law

- Set up a system for collecting and paying VAT

- File your VAT return (you can reclaim your import VAT at the same time)

Logistics

- Choose your UK-based fulfillment provider

- Work with your 3PL to select the best shipping partners for your business

- Establish a returns process for UK customers

- Launch into retail and/or marketplaces

- Ensure proper customs compliance

Need Support?

If you’ve got questions about expanding into the UK we’re here to help. Get in touch with us today for expert advice and support expanding your North American brand into the UK.

If you need help with VAT and tax compliance, get in touch with SimplyVAT on the contact details below.

Phone: +44 (0) 1273 013781

Email: Partners@SimplyVAT.com

Find us online: @SimplyVAT

Contact Us

Written by Simon Clifford

Comes with a 20-year track record in senior business development and commercial roles for some of the biggest names in the logistics industry. Since joining ILG in November 2024, Simon’s expertise has been building commercial value for ILG and its customers, from fulfilment solution design to onboarding, customer care and CRM. He also heads up our Business Development Team, with a vision to grow ILG’s market share in key overseas markets as well as in the UK.

More insights >

Key Considerations when Importing Stock

This guide covers the key considerations when importing stock into the UK, helping you plan effectively and keep your supply chain moving.

Free Carrier (FCA) Incoterms Explained: What They Mean for Your International Shipping Strategy

Understand the FCA shipping term and its role in global trade. ILG explains what FCA Incoterms mean and how they affect your delivery strategy.